We are a full-service appraisal firm that specializes in commercial, farm and ranch, and residential appraisals. With locations in San Antonio, Austin, Houston, Boerne, and Dallas-Fort Worth, we provide appraisals for all purposes, including estate valuations, divorce, litigation support, lending, condemnation, easements, and more.

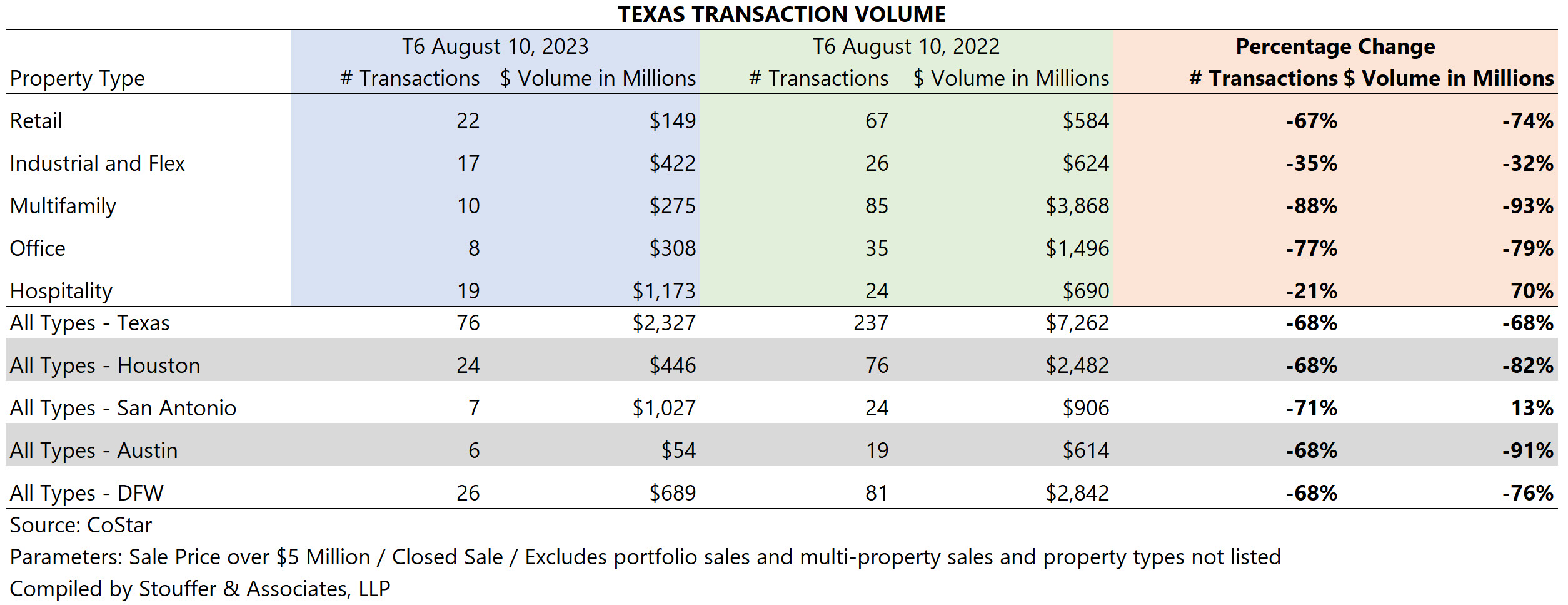

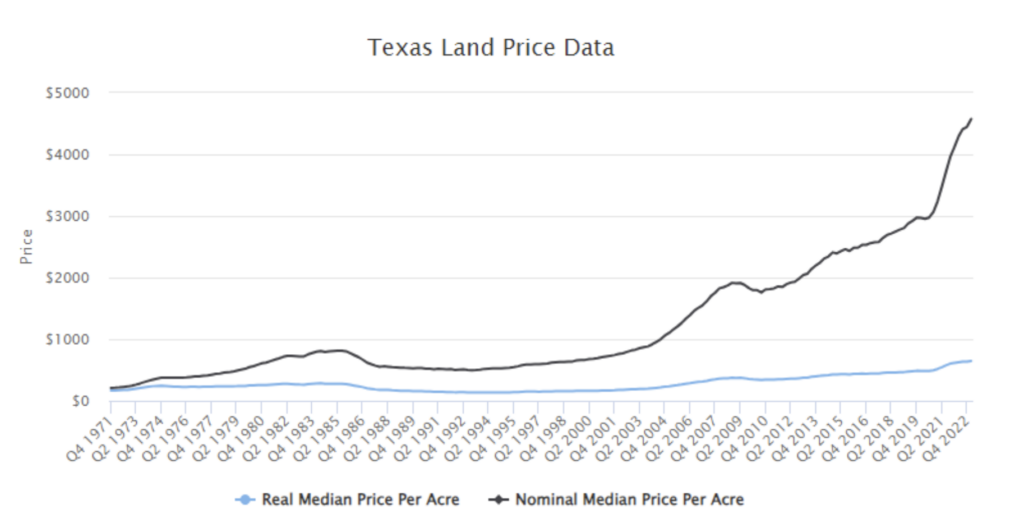

Data and information for the 2023 Texas Mid-year Market Analysis is sourced from data within our company database, various brokers and other market participants, CoStar, various MLS subscriptions, and information from the Texas A&M Real Estate Research Center, among others.

We are excited to share our thoughts and insights with you in the inaugural edition of “The Stouffer Report.”